Centrally Assessed Property Valuation Process and Timeline

The Property Tax Division of the Utah State Tax Commission is responsible for assessing mining properties and other properties that operate across county lines, such as utilities, mines, telecommunications or transportation companies. Although the Property Tax Division assesses these properties, the tax dollars belong to the counties in which the property operates. The owner of a centrally-assessed property has a right to file an appeal of the assessment by August 1. However, the affected counties also have an interest in the assessment and may file an appeal.

Assessments

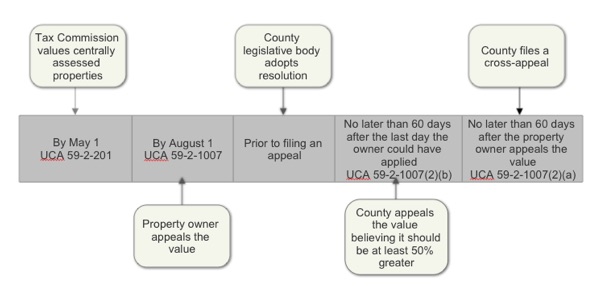

Centrally-assessed property assessments are based on self-reporting affidavits submitted by the property owners by March 1 of each year. Assessment notices are mailed by May 1 each year.

Valuation Methodologies

The Property Tax Division assessment relies heavily on the utilization of either the cost or income approach to value.

Cost Approach - is generally the historical cost less depreciation (what this property cost new at the time of acquisition less all accumulated depreciation and obsolescence), or a substitution cost (what it would cost to replace the capacity of this property).

Income Approach - substantially more complex ad more susceptible to subjective judgement. Attempt to convert future income streams into a present value that reflects what a willing purchaser would pay for that income stream.

Unitary Appraisal

The Property Tax Division is involved in assessing properties that operate in and over several states. The approach of the Property Tax Division is to value the entire operating unit, such as Delta Airlines or PacifiCorp, in its entirety and then allocate a portion of that value to the State of Utah. This allocated value is then apportioned within the State to each County.

Natural Resource Properties

For Natural Resource Properties (mining properties and oil and gas property) the Property Tax Division uses a traditional discounted cash flow methodology to determine the value of the mineral resource. The statutory formula provides that the value of the mineral resource may not be less than the fair market value of the land, improvements, and tangible personal property.

Appeals

The owner of a centrally-assessed property has a right to file an appeal of the assessment by August 1 or 90 days after the date the Commission mails the notice (whichever comes later). An owner who files an appeal must also file a copy of the application with the county auditor of each county in which the property is located. A county auditor who receives a copy of an application shall provide a copy of the application to the assessor, attorney, legislative body and treasurer.

An affected county has a right to file an appeal of the assessment if the county believes that the assessment should be 50% greater than the current value. The appeal must be made no later than 60 days after the last day on which the owner could have appealed.

An affected county also has a right to file an appeal on assessments that have been objected by the owner but must file to become a party to the hearing no later than 60 days after the date the owner appealed.

Before a county may appeal, a majority of the members of the county legislative body must approve the filing.

Pre-Hearing Process

By mid-to-late-September, the parties (or their representatives) will meet with the assigned judge in a scheduling conference. At that time, the schedule for discovery or exchange of information will be set and the matter will be scheduled for further proceedings. In the meantime, the parties are encouraged to work toward settlement.

Stipulation Process

If the property owner and the counties’ representative reach agreement with the Property Tax Division, the Commission will review the agreement and issue an order approving the agreement so long as it is not contrary to law.

If the agreement is reached only between the property owner and the Property Tax Division, the Commission must give the affected counties notice and an opportunity to intervene prior to approving the agreement. To do that, the Commission issues an Order to Show Cause. If the affected counties do not object to the agreement, the Commission issues its Order of Approval. If an affected county objects to the agreement, the matter is set for further proceedings as appropriate and the positions of the objecting counties are fully considered before the Commission acts on the agreement.

Hearing Process

If the parties do not settle the issues among them, the matter is set for a hearing. Like any other appeal, the parties are entitled to an initial hearing and formal hearing. The parties may waive the initial hearing and have the matter scheduled directly for a formal hearing. Mediation is also available.

The initial hearing process is an informal hearing in front of an Administrative Law Judge. The parties will proffer testimony and present evidence in a legal argument. After deliberating the case, the Commission issues its Initial Hearing Decision and Order. Any party to the case may, within 30 days of that order, request a formal hearing.

The formal hearing is a hearing of record. Depending on the nature of the issues involved, the formal hearing may be conducted by an Administrative Law Judge and one or more Commissioners. If the affected counties were party to the hearing proceedings, the Commission can issue its final order after deliberating the case. If the affected counties were not party to the formal hearing, an Order to Show Cause is issued giving the counties an opportunity to voice objections or intervene before the final decision is issued.

After the Commission’s final order is issued, either the property owner or the affected counties, if they are party to or interveners in the case, may seek judicial review within 30 days of the decision.

Tax Refunds

Taxing entities are obligated to refund to taxpayers amounts determined to have been collected in error or illegally or because of an excessive valuation of the property.

Local governments generally have two methods for the payment of property tax refunds: paying refunds out of existing revenues (or fund balances) or through the imposition of a judgement levy.

Property tax judgement levies are specifically authorized by statute for eligible judgements (which generally are those judgements of more than $5000). To be eligible for imposition of a judgement levy, the refund must result from a final decision of a court, board of equalization, or the State Tax Commission. A final order is one for which either ALL appeals have been completed or the timeframe in which appeals could be filed has run. Specific truth in taxation notice requirements are imposed on local governments imposing judgement levies.